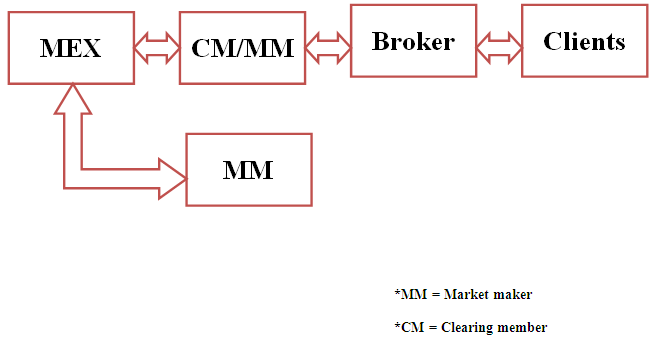

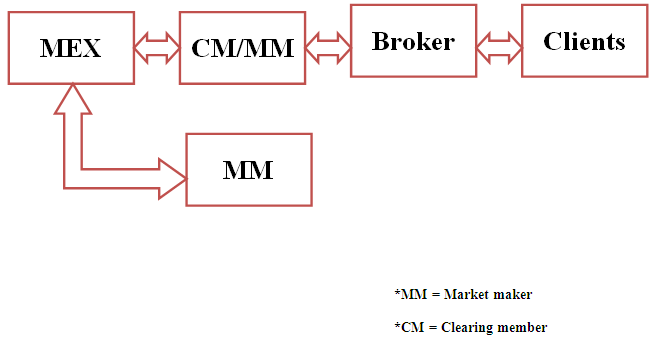

Market Mechanism

- Market Makers (MMs) will be provided with the choice of External Price Link as a reference price.

- MMs can choose the Spread and can show their intentions of Buy and Sell quantity for different contracts; however maximum permitted spread will be decided by the Exchange itself.

- MMs must show their intentions of both buy and sell quotes, which will be displayed to all the clients in their market depth. And the clearing and settlement will be done through Automated Trading System (ATS).

- Intentions of the MM will represent the Market Depth.

- Quotes of MMs will be sorted as per their defined spread and order will be matched on Price-Time priority.

- Clients and MMs too can close any of their open position at the available best Bid and Ask.

- If Market Maker closes its open position, further profit and loss of the respective client will be transferred to the next Market Marker available on best Bid and Ask, with no effect on the clients open position.

For detail information about Market Mechanism, Click Here

|